All about Home Equity Loans Vancouver

Table of ContentsLoans Vancouver - TruthsThe Ultimate Guide To Home Equity Loans BcLoans Vancouver Things To Know Before You BuyOur Mortgages Vancouver PDFs

If you are unable to pay the financing back, you might lose your house to repossession. Are Residence Equity Loans Tax Deductible? The interest paid on a home equity funding can be tax deductible if the profits from the lending are used to "get, build, or considerably improve" your house - Home Equity Loans BC.How Much House Equity Lending Can I obtain? For professional consumers, the limitation of a home equity lending is the amount that gets the borrower to a mixed loan-to-value (CLTV) of 90% or much less. This implies the overall of the equilibriums on the home loan, any existing HELOCs, any kind of existing home equity financings, and also the new house equity finance can not be greater than 90% of the assessed worth of the home.

Can You Have a HELOC and a Home Equity Loan Concurrently? Yes. You can have both a HELOC and a residence equity loan at the exact same time, given you have enough equity in your home, as well as the income as well as credit to obtain authorized for both. The Bottom Line A house equity car loan can be a much better choice financially than a HELOC for those that know exactly just how much equity they require to take out as well as want the safety and security of a fixed rate of interest price.

One of the benefits of homeownership is having the ability to use the equity in your residential property as well as utilize it as security for a funding when cash is required to spend for significant costs such as house improvements or financial obligation combination. Funded in a swelling sum and also paid back over 5 to three decades at a fixed rates of interest, residence equity lendings can be an excellent choice for these kinds of huge cash requirements.

About Home Equity Loan Vancouver

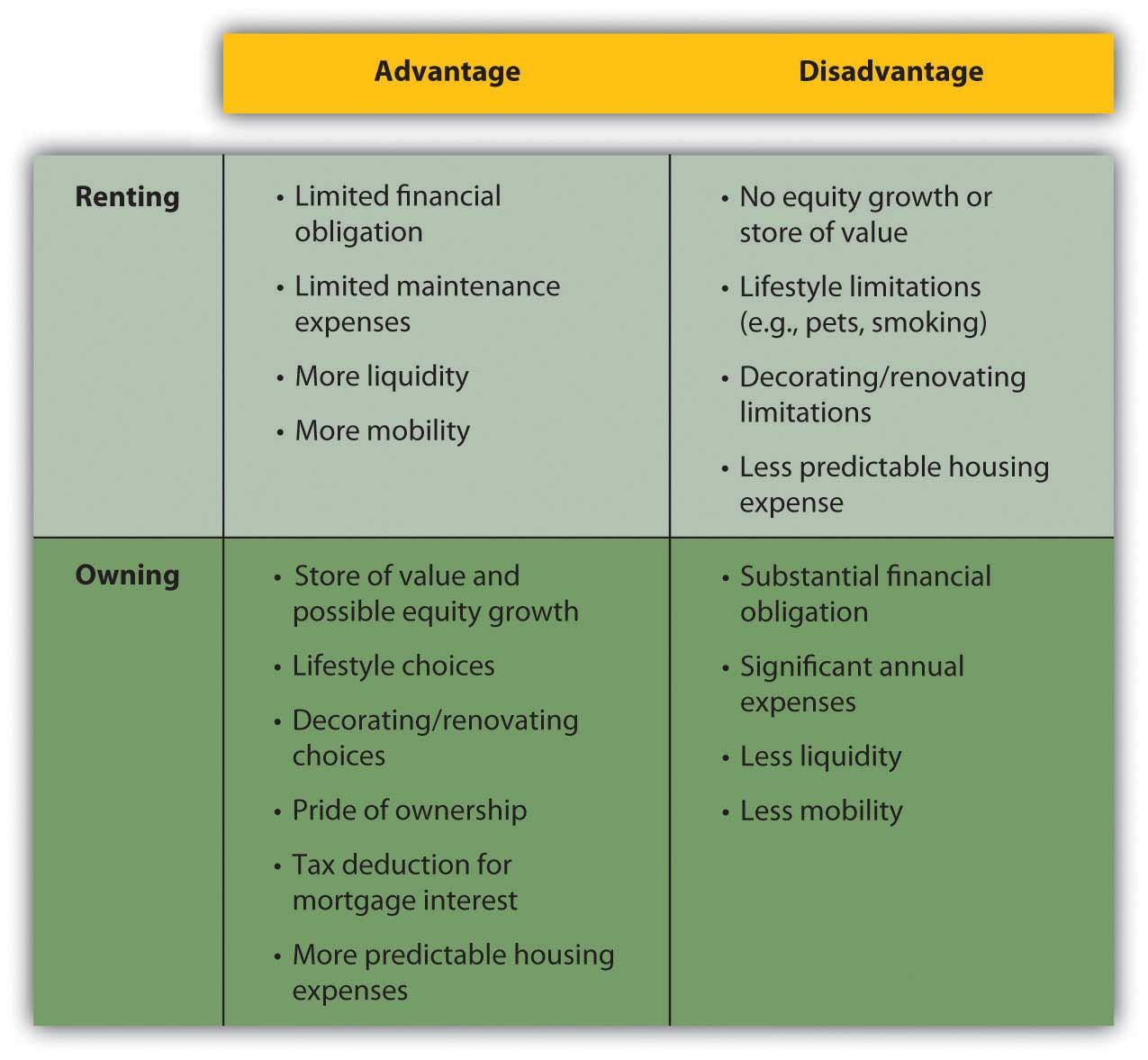

Right here are the advantages and disadvantages of home equity finances. Key benefits of house equity fundings, Those that obtain house equity financings might discover there are several benefits versus other types of borrowing. Fixed rate of interest, Unlike a home equity credit line (HELOC), which features a variable rate of interest that can boost unexpectedly at any moment, the rate of interest on a residence equity financing is taken care of for the life of the car loan."When you obtain a residence equity loan, right from the beginning, you will certainly understand precisely just how much you'll need to pay back each month and also what the rate of interest rate will certainly be," claims Sam Eberts, younger partner with economic solutions firm Dugan Brown.

Lengthy payment terms, The settlement terms on house equity car loans can be as long as 20 years. This truth, paired with lower rate of interest than unsecured finances can convert browse around these guys right into an extremely cost effective month-to-month payment installation. Feasible tax-deductible rate of interest, Another prospective advantage of home equity lendings is the tax obligation write-off.

Getting approved for a house equity loan usually needs having in between 15 percent to 20 percent in equity in your residential or commercial property. A house equity loan is tied to your residence. If you choose to market the residence, you will be needed to repay the funding."Oftentimes, you might be able to make use of the profits of your home sale to repay both car loans," states Sterling.

Indicators on Second Mortgage Vancouver You Should Know

HELOCs, Both a residence equity lending and also a home equity line of credit score (HELOC) utilize your home as security when borrowing money. Nonetheless, there are also several distinctions between these 2 monetary products, making it essential to do your study and understand which one is genuinely ideal for your requirements and monetary photo.

Furthermore, this option features a fixed rates of interest for the life of the funding and fixed month-to-month payments, which can be a more secure wager for those on a tight budget plan."Residence equity fundings give you the safety of knowing your precise regular monthly repayments," claims Sterling, of Georgia's Own. HELOCA HELOC is a revolving line of credit scores comparable to a charge card.

You should believe thoroughly about whether you are comfy using your home as security before proceeding with this kind of financing remembering that if for some reason you skip, you might shed your residence.

Rumored Buzz on Foreclosure Loans

Alternatives to a residence equity lending, A residence equity financing isn't your only option when you require cash. The upside of this route is that you're not devoting to borrowing the whole amount, so you do not immediately have to begin paying passion on it.

Visualize you're checking out what you assume will certainly be a $30,000 house repair. If you secure a $30,000 house equity financing, you'll get on the hook for rate of interest on that particular whole $30,000. If you protect a $30,000 HELOC, yet your repair only winds up costing $25,000, you'll stay clear of paying rate of interest on the staying $5,000 (presuming you do not borrow it for an additional purpose).

This involves refinancing your mortgage to a new finance-- ideally, one with a lower rates of interest. You borrow even more than the sum of your impressive house loan equilibrium. By doing this, you obtain the difference these details in money and utilize that money as you please. If you owe $150,000 on your home mortgage however do a cash-out re-finance, you might obtain a new loan worth $180,000.